Notices Related to Replacement of Listed Compan...

Notice of Cancellation of Original Share Cert...

Notice of Intention to Issue New Share Certificate

Notice of Cancellation of Original Share Cert...

Notice of Intention to Issue New Share Certificate

Notice of Cancellation of Original Share Cert...

Notice of Intention to Issue New Share Certificate

Notice of Cancellation of Original Share Cert...

Notice of Intention to Issue New Share Certificate

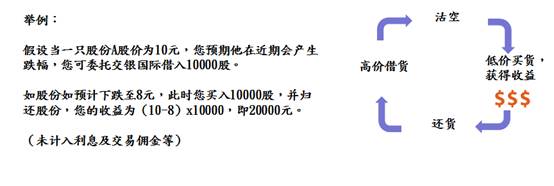

Short-selling is a strategy used when the investor anticipates the price of a stock to fall, by borrowing and shorting the stock when the price is high, and buying back and returning the stock when the price is low, making a profit on the difference.

Example:

Assuming the share price of a stock A is $10 and you anticipate it to decline in the near term, you can instruct BOCOM International to borrow 10,000 shares.

If the share price falls to $8 as expected, you can buy back and return the 10,000 shares. Your gain will be (10-8) x 10000, i.e. $20,000.

(Excluding interest, commission, etc)

[Graph translation: Borrow securities when the price is high => Shorting=> Buy back when the price is low and profit from the difference => Return the securities]

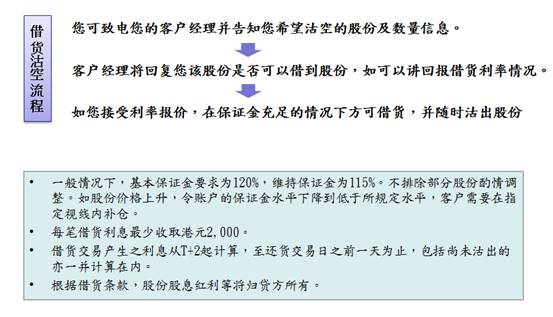

Procedures of short-selling:

Inform your account manager which stock you intend to short and the number thereof.

The account manager will reply whether the shares can be borrowed. If possible, you will be provided a quote of the lending rate.

If you accept the quotation, securities can only be borrowed when sufficient margins are paid. You can short sell the shares at any time.

· Under normal circumstances, the basic margin requirement is 120% and should be maintained at 115%, not excluding the possibility of discretionary adjustment for certain stocks. In case of a price hike which brings the account margin below the stipulated level, the client is required to top up his/her margin account within a specific timeframe.

· A minimum interest of HK$2,000 will be charged for each short-selling transaction.

· The interest from a short-selling transaction is calculated starting on T+2 to the day prior to the return of the borrowed securities, including securities that are not yet sold.

· According to securities lending clauses, the lender will be entitled to dividends and bonus shares incurred.

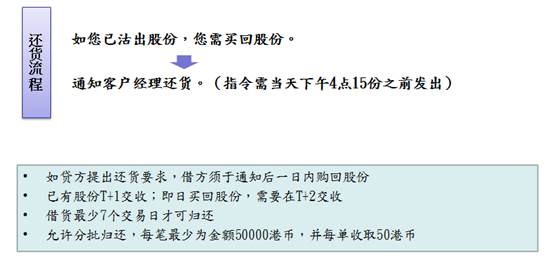

Procedures of return:

If you short-sell the stock, you need to buy back the shares.

Instruct your account manager to return the borrowed securities (an order shall be made prior to 4:15 pm of the day).

· If the lender requests a return, the borrower is required to repurchase the shares within one day after the request is made.

· For existing shares, settlement shall be made on a T+1 basis. For shares repurchased on the same day, settlement shall be made on a T+2 basis

· The borrowed securities can only be returned after a minimum of 7 days.

· The borrower is allowed to return by batch and each batch shall be worth a minimum of HKD50,000. HK$50 will be charged for each transaction.

© BOCOM International Holdings Company Limited 2016 Copyright Reserved 沪ICP备18022608号-1